London Climate Action Week is the hub for a massive number of events and ideas that are celebrated over one week at the end of June in London. This year’s theme of “Harnessing the Power of London for Global Climate Action” set a high bar to think big and act bigger. I was therefore pleased to attend the LCAW Live and the Climate Innovation Forum both at Guildhall. At London Live we heard from Ambassador Majid Al Suwaidi the Director General of COP28 and the UN Climate Change high level champion, HE Razan Al Mubarak. Clearly they wanted to set the tone for COP28 but noted that geopolitics and global polarisation might hinder progress. HE found hope in “ambition in the real economy,” emphasising the power of real-world actions and the transition to a net zero, climate-resilient, and nature-positive economy. Later in the Conference Ben Stimson of the Bank of England spoke about the Bank’s own need to create operational resilience and gave a revealing speech as to the Bank’s ambitious target and an insight into how the Bank works and thinks. His full speech is here https://www.bankofengland.co.uk/speech/2023/june/ben-stimson-keynote-speech-on-boe-climate-transition-plan Whilst many organisations wonder about the need for a transition plan Ben put it succinctly that we need a plan because the science tells us that climate is adversely affecting our world, there is legislation that requires a transition and by taking steps an organisation becomes more resilient and reliable. The Bank is also taking a lot of care over its supply chain and the need to align all to the same targets and help them along the way. At the Climate Innovation Forum we started the day with keynote speeches by the Lord Mayor and then Chris Skidmore MP. The highlight was, however, when the Lord Mayor later returned in the afternoon with the King Charles III and the Mayor of London. The King had been engaged with discussions earlier in the day and visited some of the entrepreneurs who were exhibiting at the event. He joined the Lord Mayor and Mayor in launching the London Climate Clock that is counting down to 2030 recording the Mayor’s vision for London to be net zero by that date. My work on climate and environment involves me in many different organisations and in each I champion this topic. Indeed, I am the Board lead for the Bridge House Estates Board of which the City Bridge Trust https://www.citybridgetrust.org.uk/ is the funding arm. I had started London Climate Week with a blog published by Bridge House Estates (BHE) about their ambitions and actions in adopting a wide ranging and funded Climate Action Strategy – aligned to that of the City of London Corporation, the corporate trustee of BHE. It makes sense to talk about this now as BHE has set up an Investment Committee with a new investment strategy to ensure that, as a charity, it can aim high to achieve the best outcomes and lead the way for others whom BHE can influence and help. The strategy commits BHE to achieving carbon net zero in its own operations by 2027 and across the investments and supply chain by 2040. To this end, BHE is spending £3.5 million over the next five years to improve energy efficiency in its premises, including the iconic Tower Bridge, and ensuring the investment portfolios reflect these net zero goals. This new investment strategy statement will embed a commitment to ensuring that all financial, property and social investments align with the UN Sustainable Development Goals to take urgent action to combat climate change and its impacts. In addition, BHE have allocated a further £15 million towards delivering the climate commitments, with the ambition of reaching net zero across all work ahead of that 2040 target. This kind of significant investment is about putting Bridge House Estates, which has been around for over 900 years, on a sustainable footing – if not for the next 900 years, at least for the foreseeable future. In climate action, as in many other areas, BHE aspires to be a responsible leader, delivering activities in a sustainable way and sharing knowledge and ideas with smaller charities. The Trust has also signed up to the Funder Commitment on Climate Change, https://fundercommitmentclimatechange.org/ in which funders commit to practical measures to play their part in tackling climate change. It’s this kind of innovative approach that will see Bridge House Estates and its trustee at the forefront of the drive to net zero in the years to come. I am proud to be part of this transformation and transition.

0 Comments

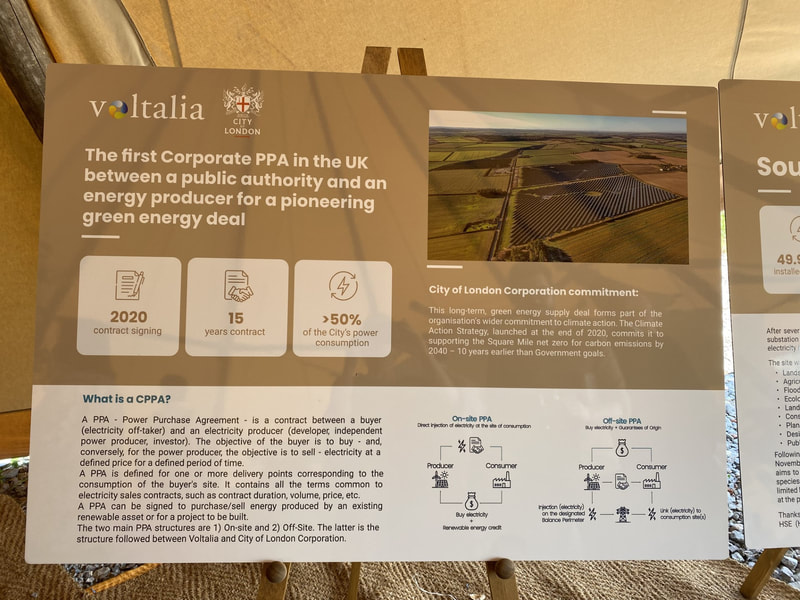

Alderman Alison Gowman at South Farm Solar Park Dorset Alderman Alison Gowman at South Farm Solar Park Dorset Travelling west from London to a field for a party sounded a lot like a free ticket to Glastonbury but it turned out be a lot longer lasting! I was heading up the City of London Corporation’s team at the official opening of the South Farm Solar Park in Dorset. The City Corporation created a radical costed and innovative Climate Action Strategy two years’ ago which commits to achieving net zero carbon emissions in its own operations by 2027 and aiming to become net zero across its investment and supply chain by 2040, whilst also supporting this for the whole Square Mile by the same year. As part of that strategy the City Corporation agreed in 2020 a £40 million deal with international energy provider Voltalia to buy all the electricity produced by a new solar farm for the next 15 years. This has now been achieved. I was delighted to visit and see it in operation on a very sunny day. It has over 91,000 panels ensuring that the site will have a capacity of 49.9 megawatts – equivalent to the annual electricity consumption of approximately 35,000 people. The facility has been providing over half of the City Corporation’s electricity from January 2023. The deal will increase the green energy supply, has no reliance on taxpayer funding, and helps the transition quickly away from fossil fuels. The deal agreed under a Power Purchase Agreement (PPA) is a long-term contract between an electricity generator and the customer – it is the first of its kind in the UK to be signed directly between a renewables producer and a governing authority. When you next look around the City you will see the iconic landmarks that the City owns and manages powered by renewable electricity - that includes Tower Bridge, Hampstead Heath and the Barbican Centre. Whilst some are sceptical of these deals that use up arable land and may overwhelm a local area this transaction has been carefully calibrated and should benefit everyone - from the environment to local people. Throughout its construction, Voltalia has invested more than £1,000,000 in local supplier partnerships – all based within 25 miles of the park. Voltalia’s local supplier investment at South Farm Solar Park has totalled over £4 million across the Southwest to date. I was pleased to have helped spearhead the City’s Climate Action Strategy back during the dark days of the pandemic and then been able to see the scheme operating at 100% capacity on the sunny day in June when we visited. This scheme is a pioneering blueprint by the City Corporation for local authorities across the UK, cutting carbon emissions and fossil fuel use, and giving cheaper, more secure energy, protected from the price volatility of energy markets. |

Details

AuthorAlison Gowman Archives

January 2024

Categories

All

|

Follow Alderman Alison Gowman on Twitter: https://twitter.com/GowmanAJ

Alison Gowman: As an elected Alderman within the City of London: https://democracy.cityoflondon.gov.uk/mgUserInfo.aspx?UID=229

Privacy policy: https://www.alisongowman.org/privacy.html

Cookie policy: https://www.alisongowman.org/cookies.html

Terms & conditions of website usage: https://www.alisongowman.org/tandc.html

Alison Gowman: As an elected Alderman within the City of London: https://democracy.cityoflondon.gov.uk/mgUserInfo.aspx?UID=229

Privacy policy: https://www.alisongowman.org/privacy.html

Cookie policy: https://www.alisongowman.org/cookies.html

Terms & conditions of website usage: https://www.alisongowman.org/tandc.html

RSS Feed

RSS Feed